- Smart Payment Security

- Intelligent Terminal

- Fintech Services

- Solutions

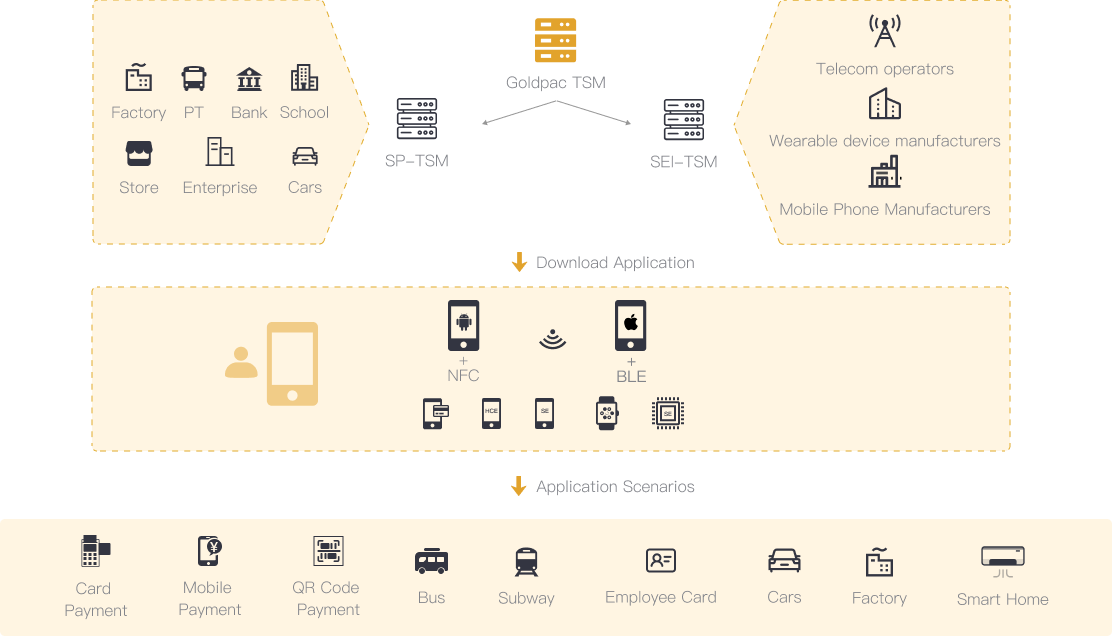

The mobile payment segment is becoming more and more popular, and the emergence of NFC payment is facilitating the replacement of traditional cards. In the SE-based NFC payment mode, the management of SE security chips and security applications is inseparable. In payment solutions based on wearable devices and mobile terminal devices, it is necessary to meet the needs for secure memory management, secure application download, and multi-participant cooperation. The TSM platform based on the GP specification has become a standardized application management and download specification for the entire industry.

The TSM Platform provides a conduit for standard products to perform memory management, over-the-air application download and application activation of SE security components. the emergence of the TSM platform effectively changes and improves the application scenarios for mobile devices and wearable devices. Cell phones and terminal devices can be equipped with various industry applications including banking applications, public transportation applications, security authentication applications, etc. to facilitate actual business processes such as payment authentication.

NFC mobile payment is an emerging business that spans multiple fields such as the Internet, finance and telecom and offers huge development potential and opportunities. Integrating multiple industries such as telecom operators, financial institutions, third-party payment companies and retailers, Goldpac has built an open TSM ecosystem, which enables participants to share cross-industry service resources and infrastructure to bring about industry cooperation and resource sharing,. This in turn provides a broader market for application providers and richer mobile payment services for users. Thus promoting the rapid development of the mobile payment industry.

The TSM platform can be docked with institutions such as banks and third-party payment systems to provide over-the-air downloading, application activation, device management and other functions in devices such as wearable and small terminals based on SE chips, and can be docked with institutions’ service systems for related business services.

The TSM platform is equally valuable for telecom operators, cell phone manufacturers, wearable device manufacturers and other business systems to provide secure memory management, application downloading, over-the-air card issuance, application activation, recharge and other business processes to build a new ecology for mobile payment.

The TSM platform can also be applied to multiple scenarios in multiple different industries such as the Internet, Internet of Things, transportation, government and enterprises, industrial parks, etc. It can simultaneously provide services in cross-industry services, infrastructure, travel and shopping, identification and other scenarios based on the platform system and physical hardware devices used. It can help promot the rapid development of the mobile payment industry.

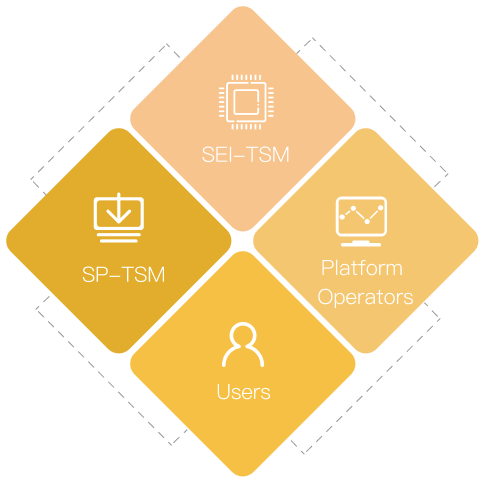

Build a public service platform that provides banks and industries with application issuance and management based on a trusted organization to achieve the interconnection of industry applications, resource sharing, and mutual trust between entities.

Assumes the role of security template issuer, controlling and managing the master key of the security module.

Cardholders can load financial and other industry applications on their cell phones, wearable devices or other secure devices, and use these industry applications as the acceptance terminal.

Depending on the trust level of the application issuer, create payment application data and supporting account data in accordance with the prescribed format and security encryption requirements; be responsible for reviewing the security, legality and standardization of the payment application submitted by the application issuer; assume responsibility for the query, backup, loss and replacement of application data for customers.

• support SE management on devices;

• Control primary security domain keys;

• Creation of secondary security domains and initialization keys;

• Space management for SE devices

• Provide SE lifecycle and security domain management; • Provide application download service; • Provide application lifecycle service; • SE information for unified management services.

• Support integration with secure component providers; • Application download and card personalization; • Manage financial applications, transportation applications, IoT applications; • Support application loss, deletion, and device replacement.

• Browse application products; • Download financial, industry and other applications; • Use-related application services.

Application download supports a variety of security devices, such as cell phones, wearable devices, security authentication devices, IoT devices, etc.

Support users to download various application services, such as banking, public transportation, retail, security authentication, government, IoT

Support utilization in a variety of application scenarios, such as bank card consumption, cell phone payment, bus card use, access control card use, IoT application download, etc.

Support the management of the entire life cycle of the business: such as card issuance, lost card, disassociation, top-up, and deletion of the card.

Support management of SE security keys, including the primary and secondary security domain initialization keys.

Support all GP modes (CM, DM, AM).

• Eliminate need to build system, save integration costs;

• Platform increase effectiveness of promotion channels and boost chip/module sales.

• Charges are based on the number of applications downloaded;

• One-time fee for service access;

• Hosted operation management service fee.

• Eliminating system building, saving interface costs.

• Platform promotion channels to boost app downloads.

• Convenient top-up, secure payment;

• Traffic and travel;

• Access control identification fast and accurately.