- Smart Payment Security

- Intelligent Terminal

- Fintech Services

- Solutions

The products make reasonable use of multi-party big data sources to help banks conduct marketing analysis under the condition of protecting customer privacy and absolute security of information.

At present, the application to banking scenarios include user acquisition, activation, customer group classification management, credit risk control, etc., to meet the needs of major banks in a diversified financial market.

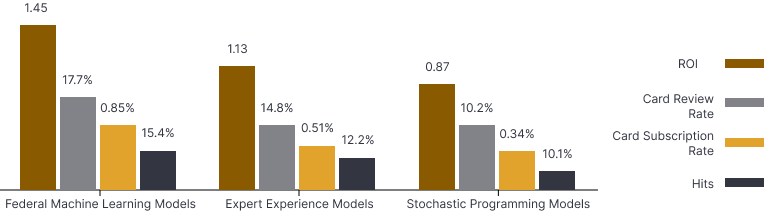

Use federal learning and privacy computing modeling techniques to mine potential users for bank marketing campaigns, optimize delivery effect and improve the efficiency of attracting new users.

Using privacy computing technologies such as anonymity query and multi-party secure intersection to assist banks to join with external third-party data sources to filter and mine their own silent users, optimize the label and then accurately deliver marketing content to activate users.

Using federal learning, multi-party secure computing, anonymity query and other technologies to help banks optimize their customer base classification and refine user tags by comparing big data from UnionPay and carriers, helping banks to digitize thousands of people for accurate marketing

Using privacy computing technology to help banks effectively compare data from all parties, select suitable samples for analysis, consider users’ credit qualifications and spending habits comprehensively, and improve the efficiency of card opening and approval

The financial service data of hundreds of millions of users nationwide Highly compatible with the target matching clientele of bank customers

Cell phone number/age/number of card subscriptions/financial spending characteristics/Credit Card Rating/Value of financial products

Province/Do you have a Platinum Card?/Are you interested in financial management?/Do you follow marketing campaigns?/Financial consumption level